COVID-19 Tax Relief Added to Increasing Share of Households Paying No Income Tax

According to the Tax Policy Center, an estimated 60 percent of U.S. households paid no income tax in 2020, up from around 43 percent of households in 2019.

4 min read

According to the Tax Policy Center, an estimated 60 percent of U.S. households paid no income tax in 2020, up from around 43 percent of households in 2019.

4 min read

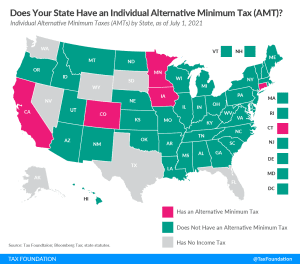

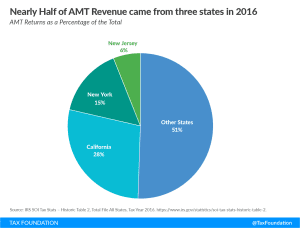

The original goal of AMTs—to prevent deductions from eliminating income tax liability altogether—can be accomplished best by simplifying the existing tax structure, not by creating an alternative tax which adds complexity and lacks transparency and neutrality.

2 min read

August 15th was the deadline to take advantage of the premium tax credits originally provided in the Affordable Care Act and recently expanded in the American Rescue Plan. Future extensions may provide longer-lasting benefits, although the extensions may create trade-offs for consumer choice and program costs.

5 min read

CBO data shows that the TCJA reduced federal tax rates for households across every income level while increasing the share of tax paid by the top 1 percent.

4 min read

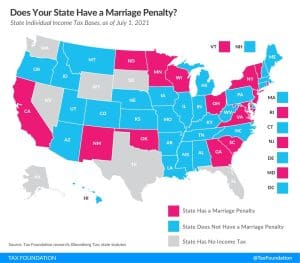

Fifteen states have a marriage penalty built into their bracket structure. Does your state have one?

2 min read

To fully follow the Scandinavian model would require additional taxes that place a higher burden on middle-income earners, but instead, Biden proposes higher taxes on corporations and households making more than $400,000.

3 min read

Louisiana legislators passed a tax reform plan that has received overwhelming support in both the House and Senate, but voters will get the ultimate say on whether that plan succeeds. In light of this, it may be valuable to walk through what is included in these reforms and what effect the changes will have on taxpayers.

5 min read

As economies are starting to recover and growth is expected to rebound in the region during 2021, Asian and Pacific countries should start exploring changes to their fiscal tax policies while carefully evaluating the optimal time for eliminating fiscal stimulus and temporary tax relief.

4 min read

Even as lawmakers in eleven states have cut income taxes this year, the D.C. Council has responded to surpluses and growth by voting to include substantial income tax increases in the budget.

7 min read

The media has reported on how wealthy taxpayers who own sports teams lower their tax liability by deducting the cost of purchasing a sports team over 15 years. Contrary to claims that deducting the cost of a sports team from taxable income is a “loophole,” such deductions are a normal and proper part of the income tax system.

3 min read

Taken together, the proposed reforms would further solidify North Carolina’s position as a leader in sound tax policy and as a state whose tax code is among the most conducive to generating long-term economic growth.

7 min read

Last month, the Supreme Court turned back a challenge to the Affordable Care Act (ACA), allowing to stand the Individual Mandate it created that penalizes taxpayers for not having proper health insurance and opening the way for President Biden and Congress to reimplement it.

2 min read

While it is good that policymakers are taking the impact of the economy on tax revenue seriously, it is important to remember that the dynamic effect of increased spending would only offset a small portion of the total spending. In other words, new spending—like tax cuts—rarely pays for itself.

3 min read

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, individual taxpayers across America will end up footing the bill.

4 min read

New Treasury Department data released on the advance Child Tax Credit payments shows the distribution by state, including how much, on average, households in each state received. The expansion will only be in effect for the 2021 tax year—if policymakers wish to continue providing the increased benefits, they must address the administrative and revenue costs of the policy.

4 min read

On this episode of The Deduction, host Jesse Solis and Senior Policy Analyst Katherine Loughead explore how stronger-than-expected revenues and increased workplace flexibility have led to a wave of reforms aimed at enhancing tax competitiveness in states around the country.

As states close their books for fiscal year 2021, many have much more revenue on hand than they anticipated last year. Eleven states have responded by reducing income tax rates and making related structural reforms as they strive to solidify a competitive advantage in an increasingly competitive national landscape.

29 min read

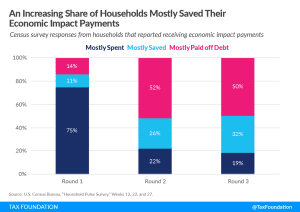

In 2020 and 2021, Congress enacted three rounds of economic impact payments (EIPs) for direct relief to households amidst the pandemic-induced downturn. Survey data from the U.S. Census Bureau indicates that households increasingly saved their EIPs or used them to pay down debt rather than spend them.

5 min read

The Biden administration has primarily focused on increasing taxes on top earners to generate revenue to fund its spending priorities. However, these proposals would hit many pass-through businesses and much of pass-through business income, including small businesses, family-owned businesses, and farms.

3 min read