All Related Articles

Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

Key Changes in Senate Tax Reform Bill Heading into the Vote-a-Rama

A brief summary of the most notable provisions of the Senate Tax Cuts and Jobs Act in the form in which it enters the “vote-a-rama.”

3 min read

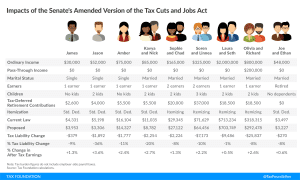

Who Gets a Tax Cut Under the Amended Senate Tax Cuts and Jobs Act?

Here’s how the individual income tax provisions of the amended Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

NCSL May Revisit Stance Fighting State & Local Tax Deduction Repeal

The National Conference of State Legislatures may revisit a decision to reject tax reform that repeals the state and local tax deduction.

2 min read

Federal Tax Reform Might Push New Jersey to Reform Tax System

New Jersey has the worst state business tax climate of the 50 states and the third highest state and local tax burden. If federal tax reform prompts New Jersey to overhaul its tax code, it’s long overdue.

3 min read

The House Takes a Big Step Forward on Tax Reform

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

Overview of the Senate’s Amendment to the Tax Cuts and Jobs Act

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

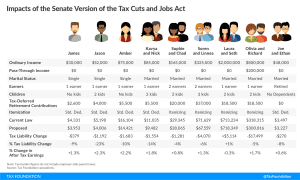

Who Gets a Tax Cut Under the Senate Tax Cuts and Jobs Act?

Here’s how the individual income tax provisions of the Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

Eight Important Changes in the Senate Tax Cuts and Jobs Act

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

Important Differences Between House and Senate Versions of the Tax Cuts and Jobs Act

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min read

How the State and Local Tax Deduction Interacts with the AMT and Pease Limitation

The way the state and local tax deduction, alternative minimum tax, and Pease limitation interact is complex. This primer makes things easier to understand.

5 min read

Updated Details and Analysis of the 2017 House Tax Cuts and Jobs Act

This comprehensive overview of the of the House Tax Cuts and Jobs Act includes a summary of its details and macroeconomic analysis of how it would impact federal revenue, wages, GDP, and after-tax incomes.

20 min read

Eight Important Changes in the House Tax Cuts and Jobs Act

The widely anticipated House Tax Cuts and Jobs Act includes hundreds of structural changes to the tax code. Here are the eight most important provisions in no particular order.

6 min read

Details of the House Tax Cuts and Jobs Act

The House Tax Cuts and Jobs act would fundamentally reform the U.S. tax code for the first time in over 30 years. Here are all the important details.

4 min read

Five Implications of Retaining the Property Tax Deduction Under Federal Tax Reform

To achieve meaningful tax reform, Congress will require significant base-broadeners. Saving the property tax deduction makes the math more difficult, but still leaves clear paths forward.

6 min read

How the State and Local Tax Deduction Influences State Tax Policy

The state and local tax deduction isn’t just a costly federal subsidy. It also skews state and local tax policy decisions.

2 min read

Examining Different Assumptions About the Republican Framework’s Impact on Lower Middle-Income Households

The broad conclusion here is that, in drafting the Republican Framework, lawmakers have left themselves with at least one significant lever for delivering middle class tax relief: the child tax credit.

7 min read