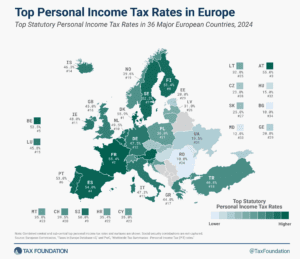

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min readProviding journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility.

Our EU tax policy team regularly provides accessible, data-driven insights from sources such as the European Commission, the Organisation for Economic Co-Operation and Development (OECD), and others.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

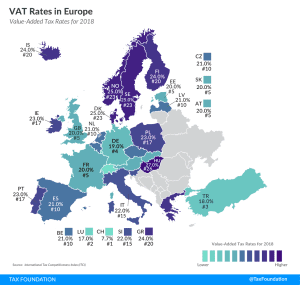

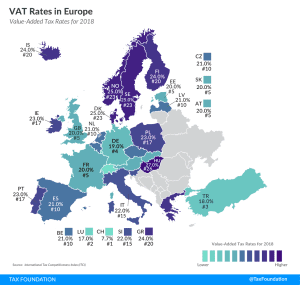

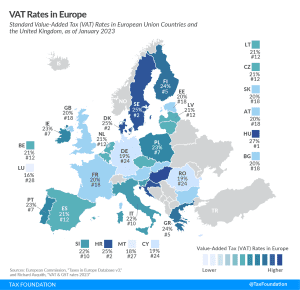

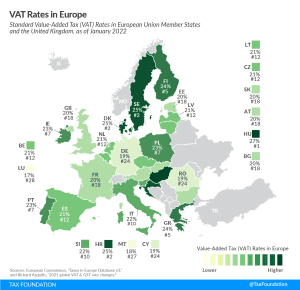

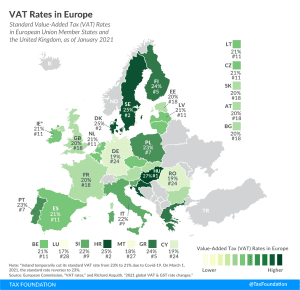

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

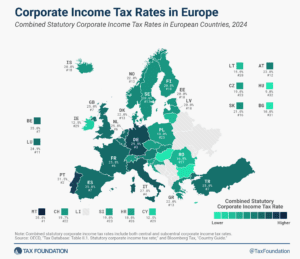

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 16 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

4 min read

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read