Key Findings

- In 2022, the Council of the European Union temporarily imposed an EU-wide windfall profits taxA windfall profits tax is a one-time surtax levied on a company or industry when economic conditions result in large and unexpected profits. Inheritance taxes and taxes levied on lottery winnings can also be considered windfall taxes on individual profits. , or “solidarity contribution,” on fossil fuel companies.

- The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. applied to taxable profits above a 20 percent increase of the average yearly taxable profits since 2018. Member States could instead implement equivalent national measures provided the measures were compatible with the objectives of the regulation and generated similar proceeds.

- Between 2022 and 2023, 15 of the 27 Member States applied the tax; 8 adopted an equivalent national measure, 3 reported that they did not have in-scope companies, and Cyprus never adopted the regulation.

- The tax was intended to be temporary; however, Spain and Hungary have extended it until 2024 and the Czech Republic has extended it until 2025. In addition, Spain, Italy, and the Czech Republic have extended the scope of the tax to the banking sector.

- Outside of the EU, the United Kingdom also implemented a windfall profits tax on fossil fuel companies in 2022 and has since extended its application to 2030.

- Defining supernormal profits is challenging, generates uncertainty for investors, and requires a constant adjustment of the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . The complexity and retroactivity of these taxes have also led to legal disputes at the EU and Member State levels.

- Windfall profits taxes can push investment and production to foreign countries with more stable and predictable tax environments. This reduction of domestic production leads to a loss of jobs and economic activity in the home country.

- Major oil and gas companies also have renewable energy branches spanning from offshore and onshore wind production to green hydrogen divisions that are affected by the windfall profits tax.

- In particular, the Spanish and British taxes are threatening domestic renewable energy investments.

- Of the roughly €27 trillion required for the EU to reach net zero by 2050, estimates suggest a majority will need to come from the private sector. However, windfall taxes reduce the amount of available capital for energy companies to invest in capital-intensive projects.

- Policymakers should implement long-term, pro-growth tax reforms that incentivize private investment and energy diversification.

Introduction

While the EU economy was still recovering from the COVID-era economic downturn and aggregate demand was driving up energy prices, the Russian invasion of Ukraine led to energy supply reduction and even higher energy prices. The dire economic environment for families and the need for increased energy security increased policy attention toward extracting revenue from fossil fuel companies.

Despite the fact that energy prices have declined from their peak, some European countries continue to rely on windfall profits taxes. These are meant to be one-time taxes levied on a company or industry when economic conditions result in large, unexpected profits, for the purposes of funding relief measures for consumers.

Windfall taxes, particularly those imposed on the oil and gas industry, often appear as a quick fix for governments seeking to raise revenue during periods of high commodity prices. However, while these taxes may offer short-term revenues, they can also trigger long-term negative consequences that undermine their intended purpose.

In 2022, the Council of the European Union agreed to temporarily impose an EU-wide windfall profits tax (the “solidarity contribution” in EU terms) on fossil fuel companies.[1] Even though these measures were meant to be temporary, Czech Republic, Hungary, and Spain extended the application of these windfall taxes beyond 2023.

Outside of the EU, the United Kingdom also implemented a windfall profits tax on fossil fuel companies in 2022 and has since extended its application to 2030.

European Countries Work Together on Windfall Profits Taxes

As early as 8 March 2022, the European Commission recommended that Member States temporarily impose windfall profits taxes on all energy providers in its REPowerEU communication. The Commission suggested such measures should be technologically neutral, not retroactive, and designed in a way that does not affect wholesale electricity prices or long-term price trends.[2]

On 6 October 2022, the Council of the European Union agreed to impose an EU-wide windfall profits tax, or “solidarity contribution,” on fossil fuel companies (oil, gas, coal, and refining sectors), however, with a different design than the Commission’s recommendations.

According to the regulation, Member States had to apply either a solidarity contribution or an equivalent national measure to the surplus profits of the fossil fuel industry in the fiscal year 2022 and/or 2023.[3] At the same time, a cap was set on market revenues for electricity generators that used infra-marginal technologies to produce electricity, such as renewables, nuclear, and lignite. The EU anticipated that the two policies would jointly raise about €140 billion, of which €25 billion would be revenues from oil and gas companies collected through the solidarity contribution.[4] The revenue would then be used to partially offset households’ high energy bills “in a non-selective and transparent measure supporting all final consumers.”

The regulation defined surplus profits as those generated in 2022 and/or 2023 above a 20 percent increase of the average profits generated in the fiscal years 2018-2021. Those profits would be subject to the solidarity contribution at a rate no lower than 33 percent. In-scope companies had to have at least 75 percent of their turnover generated in the field of the extraction, mining, refining of petroleum, or manufacturing of coke oven products. Alternatively, Member States could have enacted an equivalent national measure.

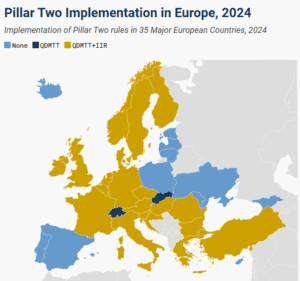

Between 2022 and 2023, 15 of the 27 Member States applied the solidarity contribution, while eight adopted an equivalent national measure. Additionally, three countries—Luxembourg, Latvia, and Malta—reported that they do not have in-scope companies.[5]

By 2023, only 16 Member States had a windfall profits tax in place, of which seven—Belgium, Czech Republic, Hungary, Italy, Portugal, Spain, and Sweden—had their own equivalent national windfall tax. Apart from the EU Member States, the United Kingdom also adopted its own windfall profits tax.

The implemented windfall taxes in Europe differed significantly in their tax rates, the sectors they targeted, and their structures. The tax rates ranged from 25 percent in the United Kingdom to 75 percent in Ireland and 80 percent in Slovenia.

For the fiscal year 2022, the EU solidarity contribution collected roughly €6.85 billion, less than 30 percent of the expected revenue. Of the countries that reported revenues in 2022, three—Poland, France, and Slovakia—collected nearly half of the revenues expected during that year.[6] While the European Commission plans to publish the final figure by mid-October, it does not appear that the measure will generate the expected €25 billion in total revenue.

Temporary, but How Temporary?

Although the EU regulation clearly states that windfall profits taxes should be a temporary mechanism and “the duration of the measure should be limited and tied to a specific crisis situation,” the Czech Republic, Hungary, and Spain have extended its application beyond 2023.[7] Though not bound by the EU regulation, the United Kingdom has also recently extended the application of its tax to 2030.

On 2 December 2022, the Czech Republic introduced the 2023 Tax Package, which, among other tax reforms, introduced a new 60 percent windfall profits tax for a period of three years (from 2023 to 2025).[8] The government also extended the scope of the tax to cover the banking sector.

The Czech finance minister announced early in 2024 that he planned to scrap the windfall tax for 2025; however, in August 2024, he changed course since “the overall revenue from the special levy on the biggest energy companies and banks still hasn’t covered the state’s expenditure on mitigating the impact of Europe’s energy crisis.”[9]

Hungary was an early adopter of the windfall profits tax. However, it did not follow the design of the EU-wide windfall tax and implemented a series of windfall taxes on different sectors, from producers of petroleum products and mining companies to pharmaceutical distributors and airline companies. Hungary applies a variety of tax bases and tax rates across its package of windfall taxes.

As an example, Hungary uses a modified corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. base for a windfall tax on energy suppliers. For producers of petroleum products, the tax base is the refinery spread reduced by $7.5 per barrel. Additionally, most of these windfall taxes are applicable for three years (from 2022 to 2024).

Spain implemented a temporary mechanism in 2021 to tax excess revenues of energy companies that benefited from higher energy and gas wholesale prices.[10] However, over time, a series of exclusions were approved, and many energy providers were left outside the scope of the mechanism.

In December 2022, Spain adopted a new windfall profits tax on the largest operators engaged in activities related to crude oil or natural gas production, coal mining, and oil refining. However, the tax differs greatly from the EU-wide windfall tax.

First, the Spanish approach uses net turnover as the tax base instead of taxable profits.[11] A tax rate of 1.2 percent applies to the sales of domestic power utilities. This means the tax base is not designed to tax profitability, whether the profits are windfall or not. Instead, it resembles more of an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. .

Second, it only applies to companies with an annual turnover exceeding €1 billion in 2019.

Third, the tax applies through the fiscal years 2023 and 2024.

Overall, the Spanish design deviates from both the temporary nature of the contribution and the prescribed tax base that the EU mandated.

After the approval of the EU-wide windfall tax, the Spanish government vowed to adjust its windfall tax to the EU design. [12] However, no amendments were introduced. In 2023, the government again announced that it planned to review the energy windfall tax during the 2024 budget approval, but a budget for 2024 was never presented for discussion.[13] For now, the tax has been extended through 2024.[14]

Spain, like the Czech Republic, did not limit the scope of the windfall tax to fossil fuel or energy companies, but extended it to also cover the banking sector. It uses a bank’s net interest income and net fees (if the net income from these sources exceeded €800 million in 2019) as the tax base.[15] The tax rate is 4.8 percent, and it is applicable for the years 2023 and 2024.

Although no longer a part of the EU, the British government also implemented a windfall profits tax. The United Kingdom’s design diverges significantly from the outline of the EU-wide windfall tax regarding the targeted sectors, tax rate, tax base, and tax period.

First, the windfall tax exclusively targets companies engaged in oil and gas extraction. Second, the current 35 percent rate (25 percent in 2022) comes on top of an existing 40 percent headline tax rate on oil and gas. The combined policies result in an overall tax rate of 75 percent. Third, the UK has opted to tax all profits of the targeted companies from May 2022 to March 2030.

Table 1. Windfall Profits Taxes in Force in European Countries, as of 30 August 2024

| Country | Tax Rate | Scope | Base | Status |

|---|---|---|---|---|

| Czech Republic | 60% | Companies in the energy and fossil fuel sectors with a total annual turnover in 2021 of at least CZK 2 billion and a current total annual net turnover of at least CZK 50 million. | Profit margin exceeding 120% of the average profit of 2018, 2019, 2020, and 2021. | In Force (Applicable for three years: 2023, 2024, and 2025). |

| Hungary | A variety of rates depending on the sector | Producers of petroleum products and mining royalties. | Varies by industry. | In Force (The first one was introduced as early as 1 July 2022; most are applicable for three years: 2022, 2023, and 2024). |

| Spain | 1.2% for energy companies | Energy companies (gas, oil, and electricity). | Sales of domestic power utilities (companies with an annual turnover exceeding EUR 1 billion in 2019). | In Force (In December 2022, two windfall taxes on the banking sector and energy companies were approved. Applicable for two years: 2023 and 2024. Previously, in September 2021, Spain approved a temporary mechanism that was in force until 31 December 2022. The mechanism consisted of a temporary reduction in the remuneration of electricity production activities to reduce windfall profits earned due to higher gas and carbon prices. The tax was payable if the gas price was higher than EUR 20/MWh. However, later on, a series of exclusions were approved, and many energy providers were left outside the scope of the mechanism.) |

| United Kingdom | 38%(35% up to 1 November 2024) | Oil and gas companies operating in the UK and the UK Continental Shelf. | On the same profits that are already subject to the UK’s oil and gas 40% headline tax, generating an effective tax rate of 78%. | In Force (Approved on 11 July 2022, applicable to profits generated on or after 26 May 2022, up to 31 March 2030. Jeremy Hunt raised the tax from 25% to 35% in January 2023 and, in the 2024 budget announcement, stated that it would remain in place until March 2029. However, with the new labor government, the tax was extended for one more year to March 2030 and the rate was increased to 38% starting from 1 November 2024. |

The Downsides of Windfall Profits Taxes

Principled tax policy should be simple, neutral, transparent, and stable. By not following these principles, windfall profits taxes fail to achieve their revenue goals and distort the energy market in the long term. While the political upsides seem obvious, the economic upsides are limited.

Defining Supernormal Returns Is Hard

Windfall profits, or supernormal returns, are payoffs to investment greater than the typical market rate of return. They are often approximated as company profits that exceed a standard rate or return in corporate equity or debt markets (such as 10 percent). Windfall profits that exceed normal returns can come from unique advantages like leading technologies, market power, investment risk, or temporary power to set prices due to innovation.

In recent decades, the energy sector has been one of the most volatile sectors in the stock market,[16] since energy producers are exposed to market risk (as macroeconomic conditions impact demand) and geopolitical risk (as oil and gas prices are heavily affected by certain international actors). When oil and gas prices increase exponentially in one year, oil and gas producers may appear to earn windfall profits, but the years of high profits often offset heavy losses when energy prices collapse.

Leaving aside the challenges of clearly and consistently defining windfall profits, many of the taxes implemented by European countries are not proper windfall profits taxes—they go beyond merely taxing windfalls. For oil and gas companies, European countries (following the EU’s recommendation) defined the windfall tax base as the difference between current profits and the profits generated over a baseline period. Nevertheless, these incremental profits are not necessarily excess or supernormal returns, and a windfall tax could instead double tax regular profits.

Although the EU-wide windfall tax was introduced to homogenize the myriad of windfall taxes European countries had already implemented as early as 2021, and tackle some of the problems these taxes had generated,[17] its final implementation has generated uncertainty for investors since it allowed countries to implement their own windfall taxes.[18] Additionally, Spain refused to change its tax base from net turnover to taxable profits. Spain’s largest electricity companies filed a motion with Spain’s High Court claiming that the new tax is “discriminatory and unjustified.”[19] Spanish companies announced that they would accept paying a tax on the windfall profits generated from the natural gas business but not a tax on all domestic revenue.[20] The Spanish government vowed on several occasions to adjust the Spanish windfall taxes and modify the tax base. However, that has not happened.

Italy was also confronted with the complexity of defining the “super” nature of the profits with uncertainties in the calculation of the taxable base. The Italian legislators had to intervene multiple times to fine-tune the taxable base and restore some certainty to the tax system.[21]

Policymakers should acknowledge that the impact of tax policy on investment decisions depends on the type of return the investment generates. Normal returns are the most affected by taxes, supernormal returns from risk and innovation are still responsive, and supernormal returns from market power are the least responsive. Targeting supernormal returns with windfall taxes can be economically counterproductive, as these returns often come from risky, entrepreneurial activity.[22]

On the Edge of Unconstitutionality

Many European countries implemented the windfall tax retroactively. Even the EU proposal in October of 2022 required that the EU-wide windfall tax be implemented for the years 2022 and/or 2023.

Non-retroactivity is a general principle on which fiscal and legal systems are built.[23] Non-retroactivity is normally considered an absolute and non-negotiable condition in criminal law, and most constitutions would consider a retroactive tax unconstitutional.[24]

Non-retroactivity is not the only reason why these windfall taxes could be unconstitutional. The constitutionality of Italy’s first windfall tax was questioned for not allowing for the deduction of certain taxes when calculating the tax base or for the distinct tax treatment of companies operating in similar sectors.[25]

Additionally, the complexity of the design of these taxes can lead to legal disputes and increased compliance costs for both governments and businesses.[26] Oil companies even sued the European Council for exceeding its powers.[27]

Last but not least, the EU used the EU Treaty’s Article 122, an emergency procedure that excludes the European Parliament, to enact the legislation. Under Article 122, the Commission initiates a legislative proposal, but the Council adopts the measure via a qualified majority vote of EU member countries. The EU-wide windfall tax passed the Council without unanimity.[28]

Windfall Profits Taxes Impact Investment, Jobs, and Economic Activity

When companies are heavily taxed through windfall profits taxes, they may be less inclined to invest in new explorations, production, research and development, or risky projects. This reduced investment can lead to a decrease in future supply, exacerbating energy shortages and leading to higher prices for consumers in the long run.[29]

The flawed design of these windfall profits taxes has created problems in almost all countries that implemented them. An EU Commission report finds that the “diverging implementation strategies across Member States have reportedly led to significant investor uncertainty,” and, therefore, the Commission’s report proposed to end these measures.[30]

Contrary to that recommendation, Spain announced in 2023 (through a government coalition agreement) that it planned to make permanent two windfall taxes[31] introduced temporarily for 2023 and 2024.[32] One of Spain’s biggest oil producers criticized this policy for creating a challenging investment environment as it considers where to locate its green hydrogen business.[33] Recently, the Spanish government announced that €0.8 billion of EU funds would be invested in Spanish companies to develop green hydrogen plants.[34]

Similarly, in the UK, the constant changes to the windfall tax have triggered a strong response from the business sector. Forty-two companies have warned that the official plans threaten £200 billion of investment in all forms of energy, including renewables.[35] Maintaining the windfall profits tax and eliminating the current investment allowance would threaten not only the oil and gas industry but also the firms that invest in renewable energies. Before the last reform, the “investment allowance,” together with other reliefs available, enabled companies to obtain relief of up to 91.25 pence in the pound when they reinvest profits in the UK oil and gas sector.

These windfall taxes are taking capital away from more carbon-intensive energy production, but they are also removing greatly needed capital from the companies that are investing in clean energy.[36]

Additionally, apart from reducing investment, windfall profits taxes can accelerate the decline of domestic oil and gas production.[37] Companies might choose to invest in regions with more stable and predictable tax environments, leading to a loss of jobs and economic activity in the home country. This shift can also reduce the country’s energy security as domestic production declines.[38]

Windfall Profits Taxes Are Hurting the Green Transition

If not taxed under the distortive windfall profits taxes, oil and gas revenues can help fund investment in renewable energy and provide the necessary investment for the green transition.[39]

The European Court of Auditors estimates that the EU financial support could help provide over €87 billion per year from 2021 to 2027 of the nearly €1 trillion per year of the total investment needed to reach the 2030 climate goals. To move the European economy to net zero by 2050, the €1 trillion per year investment must be continued through 2050.[40]

Therefore, the EU would need around 90 percent of the roughly €27 trillion to come from national and private investments. Additionally, in a previous report, the Court of Auditors estimated that EU financial support could help provide roughly 20 percent, compared to the current 10 percent, of the €1 trillion needed yearly.[41] The Court of Auditors also found that the Commission had overstated the climate spending by at least €72 billion during the 2014-2020 period.[42] Given this lower commitment from the EU and that the measures outlined by Member States are currently too vague on financing, the EU will need to shift its focus to private investment to reach any of the above-mentioned targets.

Conclusion

These “temporary” windfall profits taxes will likely fail to achieve their revenue goals and instead further distort energy markets. These taxes penalize domestic production, reduce investment in green energy, and punitively target certain industries without a sound tax base. Since energy prices have dropped, countries should consider repealing windfall taxes altogether. Temporary crisis measures cannot become the new normal, and windfall profits taxes in the oil and gas sector, or any other industry, are not principled tax policy.

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. .[43]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Council of the EU, “Council agrees on emergency measures to reduce energy prices,” Sep. 30, 2022, https://www.consilium.europa.eu/en/press/press-releases/2022/09/30/council-agrees-on-emergency-measures-to-reduce-energy-prices/.

[2] European Commission, “REPowerEU: Joint European Action for more affordable, secure and sustainable energy,” Mar. 8, 2022, https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM%3A2022%3A108%3AFIN.

[3] Council of the EU, “Council Regulation (EU) 2022/1854 of 6 October 2022 on an emergency intervention to address high energy prices,” Oct. 7, 2022, https://eur-lex.europa.eu/eli/reg/2022/1854#.

[4] European Commission, “REPowerEU: Joint European Action for more affordable, secure and sustainable energy”; and IEA, “A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas,” Mar. 3, 2022, https://www.iea.org/reports/a-10-point-plan-to-reduce-the-european-unions-reliance-on-russian-natural-gas.

[5] Cyprus did not adopt the regulation (by 30 August 2024).

[6] As reported on June 2023; see European Commission, “Report on Chapter III of Council Regulation (EU) No 2022/1854 of 6 October 2022 on an emergency intervention to address high energy prices,” Nov. 30, 2023, https://energy.ec.europa.eu/system/files/2023-06/COM_2023_302_1_EN_ACT_part1_v2.pdf.

[7] European Commission, “REPowerEU: Joint European Action for more affordable, secure and sustainable energy.”

[8] Andrea Kleinová, “Tax Package 2023 – is there more?,” Crowe, https://www.crowe.com/cz/news/tax-package-2023—is-there-more; and Jonáš Baldík, “The Sectoral Tax,” Crowe, Oct. 11, 2022, https://www.crowe.com/cz/news/the-sectoral-tax.

[9] Michal Kubala, “Czech Finance Minister Won’t Seek Ending Windfall Tax Sooner,” Bloomberg Tax, Aug. 22, 2024, https://news.bloombergtax.com/daily-tax-report-international/czech-finance-minister-wont-seek-ending-windfall-tax-sooner.

[10] TaxNotes, “Electricity Producers Ask EU to Review Spanish ‘Clawback’ Tax,” Oct. 4, 2021, https://www.taxnotes.com/tax-notes-today-international/excise-taxes/electricity-producers-ask-eu-review-spanish-clawback-tax/2021/10/04/79h6p.

[11] Munich Business School, “Business Studies Dictionary: Turnover,” https://www.munich-business-school.de/en/l/business-studies-dictionary/financial-knowledge/turnover.

[12] Sam Edwards, “Spain Vows to Adjust Windfall Tax Bill if EU Proposal Succeeds,” Bloomberg Tax, Sep. 22, 2022, https://news.bloombergtax.com/daily-tax-report-international/spain-vows-to-adjust-windfall-tax-bill-if-eu-proposal-succeeds.

[13] Rodrigo Orihuela, “Spain Needs to Rethink Windfall Tax, Energy Minister Ribera Says,” Bloomberg Tax, Dec. 5, 2023, https://news.bloombergtax.com/daily-tax-report-international/spain-needs-to-rethink-windfall-tax-energy-minister-ribera-says.

[14] BOE, “Real Decreto-ley por el que se adoptan medidas urgentes en respuesta a las consecuencias económicas y sociales de la guerra en Ucrania,” BOE 310, Dec. 28, 2023, https://www.boe.es/buscar/act.php?id=BOE-A-2023-26452&p=20240627&tn=1#da-5.

[15] Alonso Soto and Aaron Eglitis, “ECB Cautions Spain About Hurting Bank Solvency With Tax Plan,” Bloomberg Tax, Jul. 22, 2022, https://news.bloombergtax.com/daily-tax-report-international/ecb-cautions-spain-against-hurting-bank-solvency-with-tax-plan.

[16] Fidelity Investments, “Investing in Equities with Sectors,” https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/investing-sector-guide.pdf#page=9.

[17] FreshfieldsBruckhaus Deringer, “Windfall profit taxes – do they work?,” Tax Briefing, Jun. 23, 2022, https://www.freshfields.com/49e8be/globalassets/noindex/articles/tax-briefing—windfall-profit-taxes.pdf.

[18] Romesh Vaitilingam, “Energy costs: Views of leading economists on windfall taxes and consumer price caps,” CEPR VoxEU, Sep. 19, 2022, https://cepr.org/voxeu/columns/energy-costs-views-leading-economists-windfall-taxes-and-consumer-price-caps.

[19] Bloomberg Tax, “Spanish Utility Group Challenges Windfall Profit Tax,” Feb. 16, 2023, https://news.bloombergtax.com/daily-tax-report-international/spanish-utility-group-challenges-windfall-profit-tax.

[20] Thomas Gualtieri, “Endesa Would Accept Tax on Extra Gas Profit, Not All Revenue,” Bloomberg Tax, Feb. 24, 2023, https://news.bloombergtax.com/daily-tax-report-international/endesa-would-accept-tax-on-extra-gas-profit-not-all-revenue-1.

[21] Cristina Enache, “Windfall Profit Taxes in Europe, 2022,” Tax Foundation, Oct. 4, 2022, https://taxfoundation.org/data/all/eu/windfall-tax-europe/.

[22] Tax Foundation, “Supernormal Returns: An Overlooked Foundation of Tax Policy Debates,”

[23] Ben Juratowitch, “Retroactivity and the Common Law,” Bloomsbury Publishing, Feb. 15, 2008.

[24] Stephan Wernicke, “Au nom de qui? The European Court of Justice between Member States, Civil Society and Union Citizens,” European Law Journal 13, Apr. 10, 2007, https://onlinelibrary.wiley.com/doi/10.1111/j.1468-0386.2007.00371.x.

[25] PwC TLS, “Extraordinary Contribution on Windfall profits: updated framework after the clarifications published by the Italian Revenue Agency and critical areas,” Jul. 18, 2022, https://blog.pwc-tls.it/en/2022/07/18/extraordinary-contribution-on-windfall-profits-updated-framework-after-the-clarifications-published-by-the-italian-revenue-agency-and-critical-areas/.

[26] D. Jenkins and S. Buchanan, “Legal and Administrative Challenges of Implementing Windfall Taxes,” Tax Law Review 39 (2015).

[27] America Hernandez, “Exxon sues over EU fossil fuel ‘windfall tax,’” Politico, Dec. 28, 2022, https://www.politico.eu/article/exxon-sues-european-council-over-eu-fossil-fuel-windfall-tax/.

[28] Bastien Lignereux, “Is the EU Contribution on Windfall Profits Based on the Right Treaty Provision?” Intertax 51:11 (November 2023), https://kluwerlawonline.com/journalarticle/Intertax/51.11/TAXI2023071.

[29] J. Bailey and L. de Haan, “The Impact of Windfall Taxes on Investment and Innovation in the Energy Sector,” Energy Policy Journal 48 (2016).

[30] European Commission, “Report on Chapter III of Council Regulation (EU) No 2022/1854 of 6 October 2022 on an emergency intervention to address high energy prices,” Nov. 30, 2023, https://energy.ec.europa.eu/system/files/2023-06/COM_2023_302_1_EN_ACT_part1_v2.pdf.

[31] Spain also has a windfall tax on the banking sector.

[32] Sam Edwards, “Spain’s Left Wants to Push Through Windfall Profit Tax Extension,” Bloomberg Tax, Oct. 25, 2023, https://news.bloombergtax.com/daily-tax-report-international/spains-left-wants-to-push-through-windfall-profit-tax-extension.

[33]Thomas Gualtieri, “Repsol Signals It May Cut Spanish Investments on Tax Concerns,” Bloomberg Tax, Oct. 26, 2023, https://news.bloombergtax.com/daily-tax-report-international/repsol-signals-it-may-cut-spanish-investments-on-tax-concerns; and Intereconomia, “Repsol amenaza con llevarse su inversión en hidrógeno fuera de España,” Nov. 30, 2023, https://intereconomia.com/noticia/empresas/repsol-amenaza-con-llevarse-su-inversion-en-hidrogeno-fuera-de-espana-20231130-1247/.

[34] Pepe Garcia, “El Gobierno riega con 800 millones a Repsol, EDP, Endesa e Iberdrola para desarrollar hidrógeno verde,” Intereconomia, Jul. 9, 2024, https://www.eleconomista.es/energia/noticias/12902154/07/24/el-gobierno-apoyara-con-800-millones-a-repsol-edp-endesa-e-iberdrola-para-el-desarrollo-de-hidrogeno.html.

[35] Simon Jack, “Plan to hike windfall tax sparks energy jobs warning,” BBC News, Aug. 22, 2024, https://www.bbc.com/news/articles/cje2ynege5zo.

[36] Sean Bray and Cecilia Perez Weigel, “The EU’s Windfall Profits Tax: How ‘Tax Fairness’ Continues to Get in the Way of Energy Security,” Tax Foundation, Feb. 13, 2023, https://taxfoundation.org/blog/windfall-profits-tax-eu-energy-security/.

[37] Eleanor Thornber, “North Sea Oil Producers Say New Tax Rules Mean Faster Decline,” Bloomberg Tax, Jul. 31, 2024, https://news.bloombergtax.com/daily-tax-report-international/north-sea-oil-producers-say-new-tax-rules-mean-faster-decline.

[38] R. Gordon, “Global Energy Markets and the Role of Taxation,” International Journal of Energy Economics 54 (2018).

[39] Sean Bray, Daniel Bunn, and Joost Haddinga, “The Role of Pro-Growth Tax Policy and Private Investment in the European Union’s Green Transition,” Tax Foundation, May 4, 2023, https://taxfoundation.org/research/all/eu/eu-green-transition-tax-policy/.

[40] European Court of Auditors, “EU climate and energy targets – 2020 targets achieved, but little indication that actions to reach the 2030 targets will be sufficient,” 2023, https://www.eca.europa.eu/ECAPublications/SR-2023-18/SR-2023-18_EN.pdf.

[41] European Court of Auditors, “Sustainable finance: More consistent EU action needed to redirect finance towards sustainable investment,” 2021, https://www.eca.europa.eu/Lists/ECADocuments/SR21_22/SR_sustainable-finance_EN.pdf.

[42] European Court of Auditors, “EU climate and energy targets – 2020 targets achieved, but little indication that actions to reach the 2030 targets will be sufficient.”

[43] Alex Mengden, “Worldwide Investment at Risk as Capital Allowances Phase Out,” Tax Foundation, Jun. 11, 2024, https://taxfoundation.org/blog/business-tax-reform-expiring/.

Share this article