A corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

Corporate Tax Rate

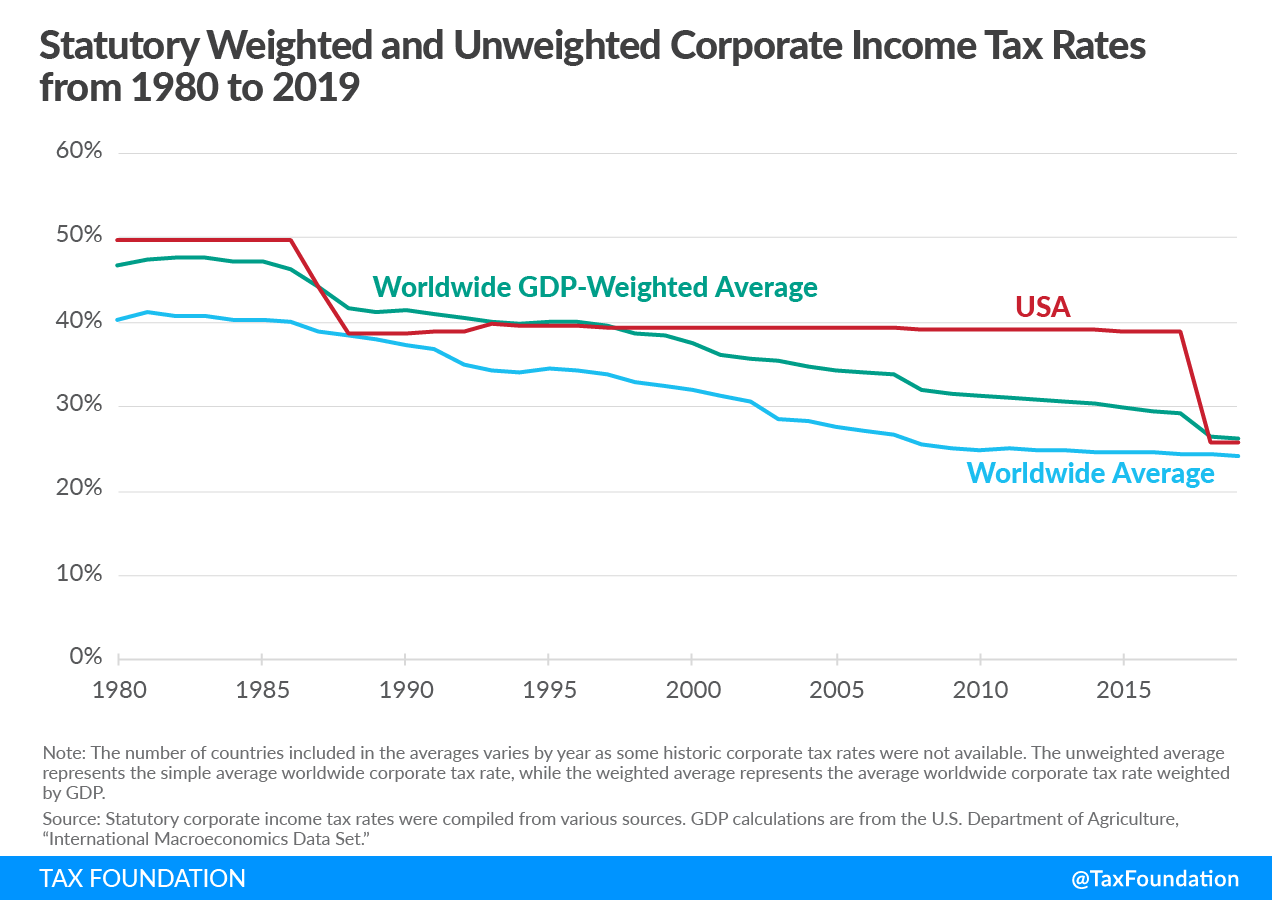

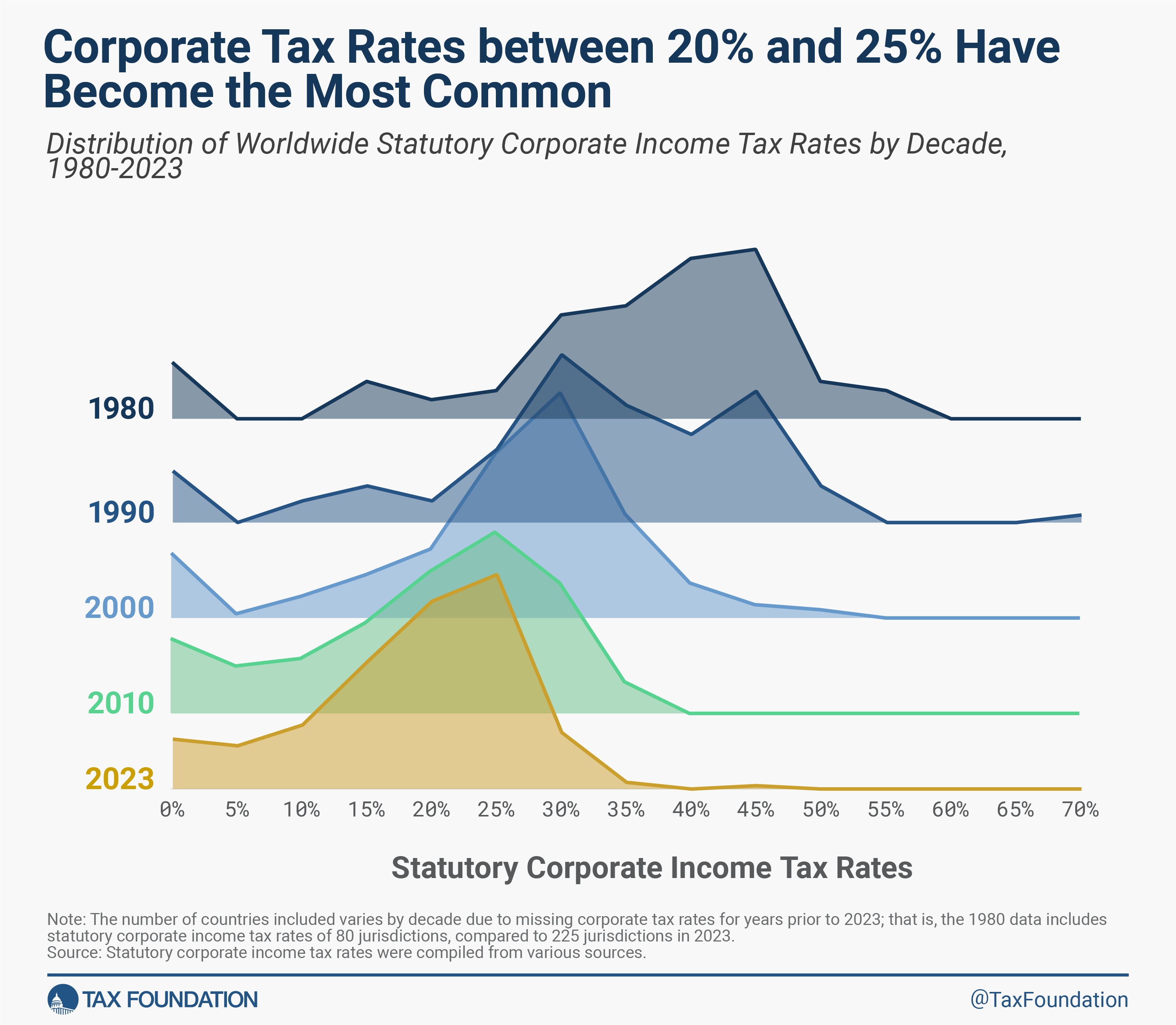

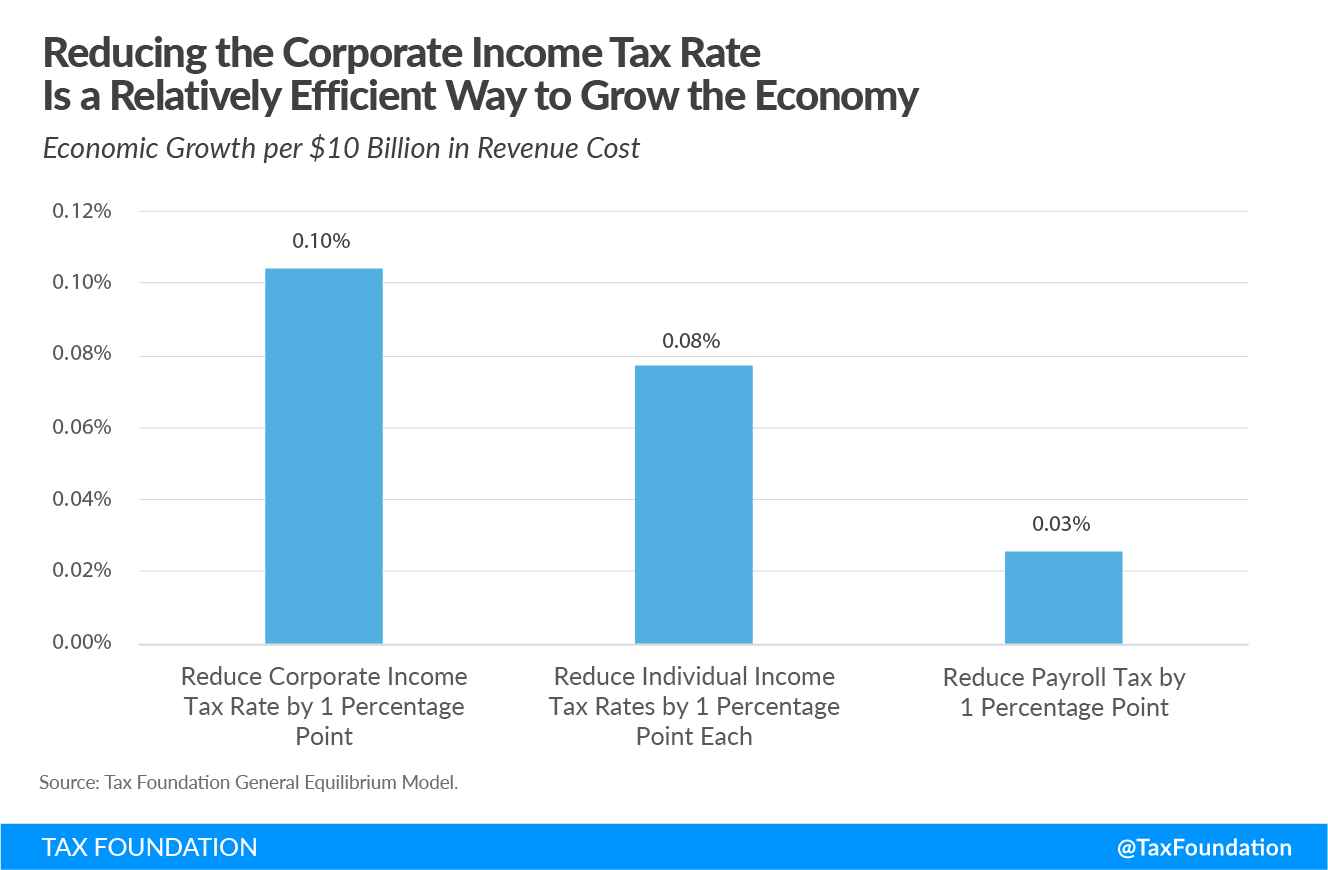

Since the Tax Cuts and Jobs Act (TCJA) of 2017, the statutory corporate income tax rate—state and federal combined—is 25.8 percent. The TCJA reduced the federal corporate tax rate from 35 percent to 21 percent, dropping the combined rate from 38.9 percent to 25.8 percent and bringing the U.S. nearer to the worldwide average.

State-level corporate income tax rates vary across the country. Six states (Nevada, Ohio, South Dakota, Texas, Washington, and Wyoming) levy no corporate income tax, while the other 44 states and the District of Columbia do tax corporate profits.

Explore the latest data on corporate rates around the world.

Corporate Tax Base

The CIT generally taxes a business’ profits, which are revenues (what a business makes in sales) minus costs (the cost of doing business).

However, costs of capital investments—such as equipment, machinery, and buildings—cannot be deducted when they incur. Instead, they have to be deducted over an extended period of time, inflating a business’ taxable income and thus increasing the cost of capital.

Carryforwards and carrybacks of net operating losses, as well as inventory valuation, also impact a business’ tax base.

Who Bears the Burden of the Corporate Income Tax?

Businesses in America broadly fall into two categories: C corporations, which pay the corporate income tax, and pass-throughs—such as partnerships, S corporations, LLCs, and sole proprietorships—which “pass” their income “through” to their owner’s income tax returns and pay the ordinary individual income tax.

While C corporations are required to pay the corporate income tax, the burden of the tax falls not only on the business but also on its consumers and employees through higher prices and lower wages.

Corporate Tax Revenue

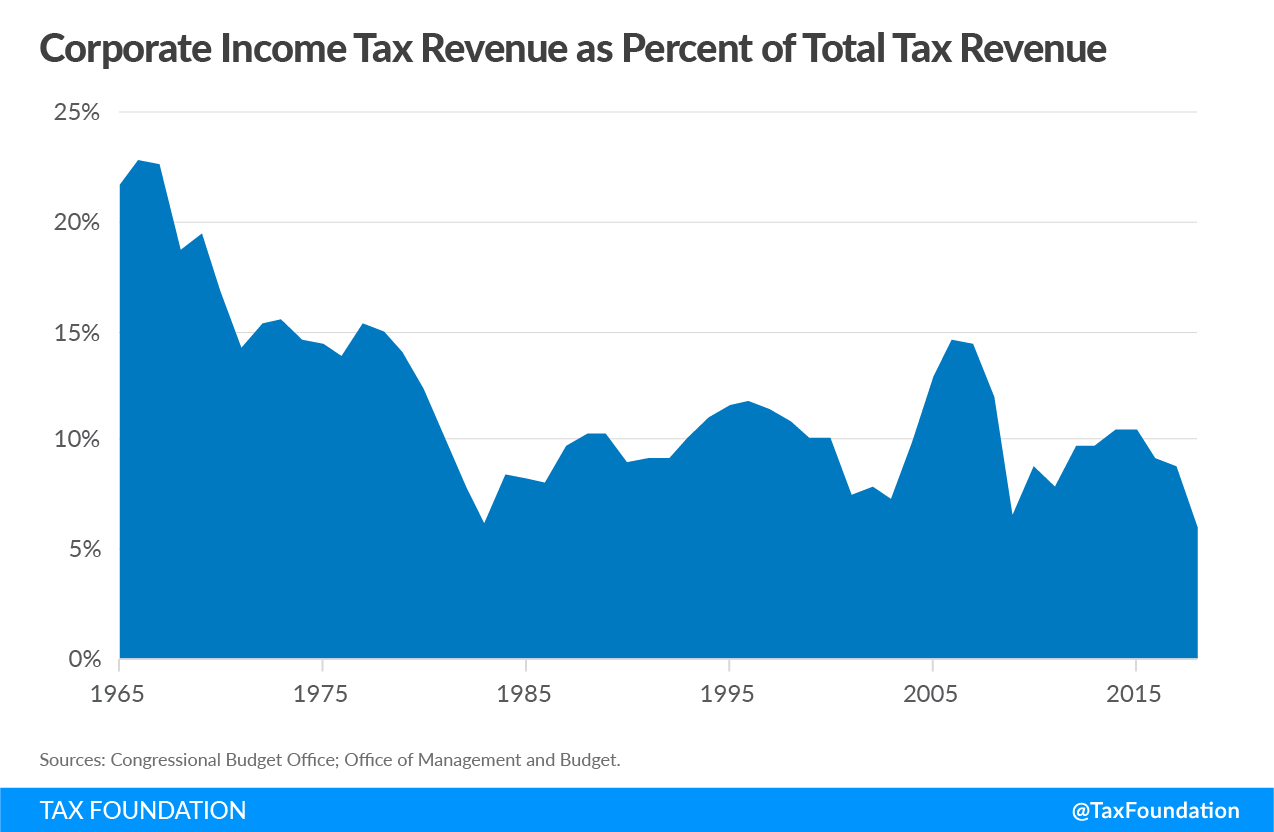

Overall, corporate tax revenue as a percent of total tax revenue has been declining over the last 50 years. This is partly because C corporations tend to be taxed more heavily than pass-through businesses, which has led to a decline in C corporations and an increase in pass-through businesses.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe