A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

How is a C Corporation and a Pass-through Business Different?

While corporations are legally separate from their owner(s), pass-through businesses are legally synonymous with the individuals who own them. In the tax code, corporations pay tax at both the entity level and again when they distribute earnings to their shareholders. By contrast, pass-throughs simply shift their gains or losses to the owners or employees, who then report the income to the IRS and pay tax accordingly. That means that pass-through businesses pay individual income taxes, not corporate income taxes.

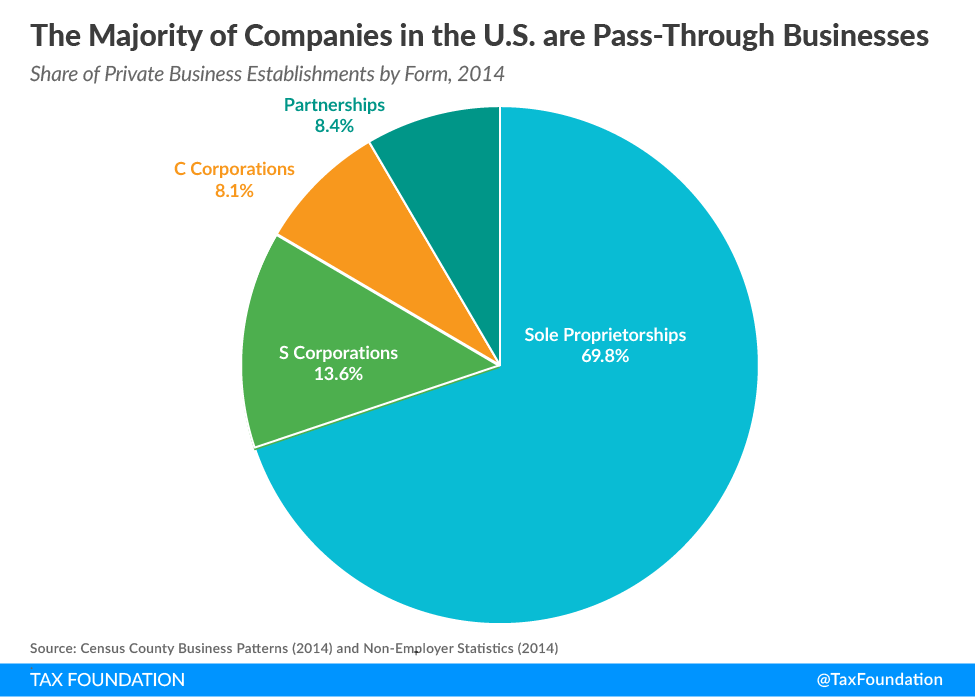

The vast majority of companies in the United States are pass-through businesses: 28.3 million out of the 30.8 million private business establishments that operated in the United States in 2014. Pass-through businesses account for over half of business income in the United States and employ over half of the private-sector workforce.

How Does Pass-through Taxation Work?

When a pass-through business earns profits, it does not directly send a portion of the profits to the Internal Revenue Service (IRS). Instead, the profit is “passed through” the business and onto the tax returns of the business owners. To determine their liability, the business first calculates its net income, or gross income less deductible expenses (see Sec. 199A expenses). Then, each person includes their portion of the business’ net income on their tax return. For a sole proprietorship, the tax is calculated on the owner’s total net income. In a partnership or S corporation, the tax is determined by percentage share of net profit.

What Other Kinds of Taxes Do Pass-throughs Have to Remit?

Pass-through businesses also pay self-employment taxes and state and local taxes. Many pass-throughs (especially sole proprietorships) must calculate their Social Security and Medicare taxes as “self-employment taxes.” In pass-throughs with multiple employees and owners, owners are required to calculate their own payroll tax liability, both on the employer and the employee side. That is, pass-throughs must pay a 6.2 percent tax on their earnings and withhold 6.2 percent of their employees’ wages at each pay period.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe