Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

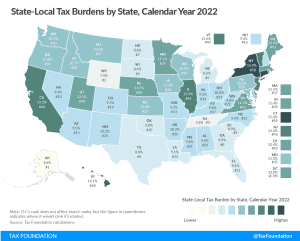

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

A new Treasury study provides data showing that the rich not only pay more than the middle class, they pay more than one-third of their annual income in federal taxes and more than 45 percent when state and local taxes are included.

7 min read

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are many ways to show how much state governments collect in taxes, the Index evaluates how well states structure their tax systems and provides a road map for improvement.

115 min read

Can tariffs truly replace income taxes in today’s economy? In this episode, we examine the bold and controversial proposal from former President Trump to replace income taxes with tariffs. What would this dramatic shift mean for everyday Americans, particularly those with lower incomes? And would it actually work?

Are tax increases on the horizon in 2025, no matter who takes office? In this episode, we explore why changes to the tax code could hit your wallet, regardless of which party comes out on top.

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

92 min read

On tax policy, Harris carries forward much of President Biden’s FY 2025 budget, including higher taxes aimed at businesses and high earners. She would also further expand the child tax credit (CTC) and various other tax credits and incentives while exempting tips from income tax.

17 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

Neither presidential candidate has a perfect tax plan. But what changes could Trump and Harris make to their respective tax plans to better serve American workers and the economy? In this episode, we dissect their plans and provide practical solutions for improvement.

CBO data shows that the federal fiscal system—both taxes and direct federal benefits—is getting more progressive and redistributive in 2024.

7 min read

What do the contrasting tax proposals of Vice President Kamala Harris and former President Donald Trump mean for Americans as the 2024 election approaches?

Social Security is by far the largest federal government spending program. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term.

33 min read

As part of the 2024 presidential campaign, Vice President Kamala Harris is proposing to tax long-term capital gains at a top rate of 33 percent for high earners, taking the top federal rate to highs not seen since the 1970s.

3 min read

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read

While tax policy was almost nonexistent in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will explore each candidate’s latest proposals in greater depth.

In her campaign for president, VP Kamala Harris has embraced all the tax increases President Biden proposed in the White House FY 2025 budget—including a new idea that would require taxpayers with net wealth above $100 million to pay a minimum tax on their unrealized capital gains from assets such as stocks, bonds, or privately held companies.

5 min read

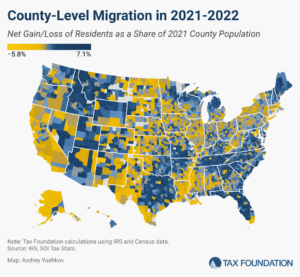

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

Dive into the highlights from the DNC as we break down Vice President Kamala Harris’s tax proposals and their potential impact on everyday families. What do higher taxes on businesses and the wealthy mean for working Americans?

The recently released FY 2025 budget for New York State signals a degree of optimism, with caveats. New York cannot tax itself toward a balanced budget.

6 min read

To encourage greater saving, the US federal income tax provides tax-neutral treatment to some types of saving through a variety of accounts. The type of tax treatment, contribution limits, withdrawal rules, and use cases for contributions all vary by account, leading to a complicated system for households to navigate.

11 min read