Corporate Income Tax Rates in Europe, 2024

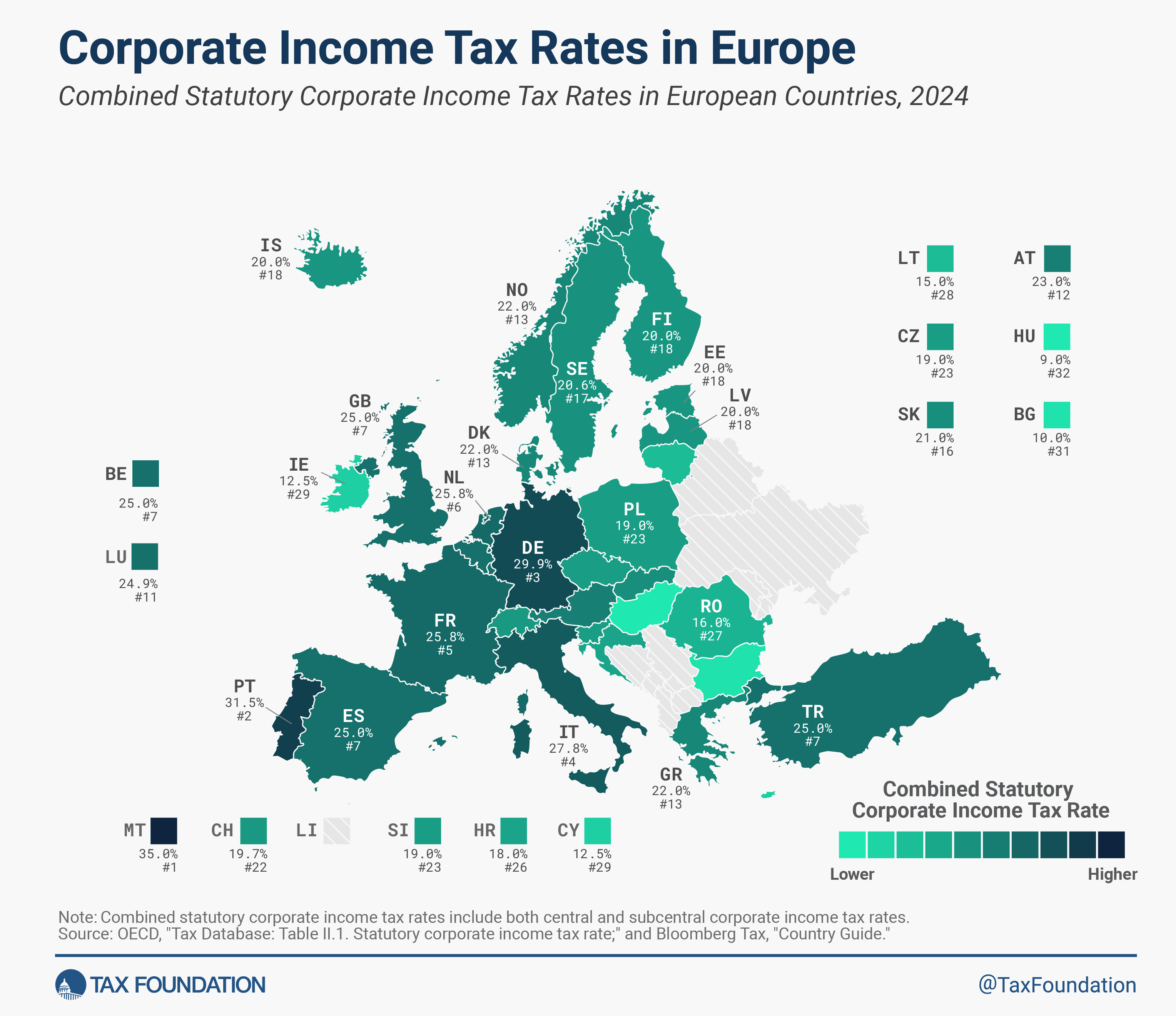

2 min readBy:European countries—like almost all countries around the world—require businesses to pay corporate income taxes on their profits. The amount of taxes a business ultimately pays on its profits depends on both the corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. and the corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate. Today’s map shows how statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rates compare across European OECD and EU countries.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeTaking into account central and subcentral taxes, Malta has the highest statutory corporate income tax rate, at 35 percent. Portugal, Germany, and Italy follow, at 31.5 percent, 29.9 percent, and 27.8 percent, respectively. Hungary (9 percent), Ireland (12.5 percent), and Lithuania (15 percent) have the lowest corporate income tax rates.

On average, the European countries analyzed currently levy a corporate income tax rate of 21.3 percent. This is slightly below the worldwide average which, measured across 181 jurisdictions, was 23.45 percent in 2023.

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years. In 2024, Austria reduced its corporate income tax rate, finalizing a 2022 scheduled tax cut. Nevertheless, of all European countries, only Turkey and the United Kingdom increased their corporate income tax rate in the last year, a trend expected to hold steady as countries have more efficient tax types to turn towards.

2024 Corporate Tax Rates in Europe

Combined Statutory Corporate Income Tax Rates in European OECD and EU Countries, 2024

| Country | Combined Statutory Corporate Income Tax Rate |

|---|---|

| Austria (AT) | 23.0% |

| Belgium (BE) | 25.0% |

| Bulgaria (BG) | 10.0% |

| Croatia (HR) | 18.0% |

| Cyprus (CY) | 12.5% |

| Czech Republic (CZ) | 19.0% |

| Denmark (DK) | 22.0% |

| Estonia (EE) | 20.0% |

| Finland (FI) | 20.0% |

| France (FR) | 25.8% |

| Germany (DE) | 29.9% |

| Greece (GR) | 22.0% |

| Hungary (HU) | 9.0% |

| Iceland (IS) | 20.0% |

| Ireland (IE) | 12.5% |

| Italy (IT) | 27.8% |

| Latvia (LV) | 20.0% |

| Lithuania (LT) | 15.0% |

| Luxembourg (LU) | 24.9% |

| Malta (MT) | 35.0% |

| Netherlands (NL) | 25.8% |

| Norway (NO) | 22.0% |

| Poland (PL) | 19.0% |

| Portugal (PT) | 31.5% |

| Romania (RO) | 16.0% |

| Slovak Republic (SK) | 21.0% |

| Slovenia (SI) | 19.0% |

| Spain (ES) | 25.0% |

| Sweden (SE) | 20.6% |

| Switzerland (CH) | 19.7% |

| Turkey (TR) | 25.0% |

| United Kingdom (GB) | 25.0% |

Source: OECD, “Tax Database: Table II.1. Statutory corporate income tax rate”; and Bloomberg Tax, “Country Guide.”

How Does Your Country Compare?

Get facts about taxes in your country and around the world.

Explore Data